- SaaS Sunday

- Posts

- Twitter Friendzones Salesforce and Insider Tips on How to Supercharge Your SaaS Business with AI

Twitter Friendzones Salesforce and Insider Tips on How to Supercharge Your SaaS Business with AI

Your Guide to the Latest Tech Developments and Strategies

Good afternoon crew,

In the fast-paced world of tech, there's always something happening, and today is no exception.

We've got news about Salesforce, game-changing ways to fight environmental problems through software, and exciting tips on how AI can help SaaS companies obtain a competitive advantage.

Let’s go!

-Alejandro

🍿 Quick Snack

💔 Is Salesforce in trouble? Twitter has cut its spending with the company by 75%

♻️ Bibak raises $6.4m to eliminate single-use plastics through software

🤖 Find out how SaaS companies can leverage AI for leverage, scalability, and profitability.

+6 funding rounds

🍔 The Full Meal

Salesforce Takes a Hit as Twitter Slashes Spending and Activist Investors Demand Change

Salesforce has suffered a major setback as Twitter has cut its spending with the company by 75%.

According to a recent report from The Information, Twitter reduced its contract with Salesforce from $20 million to around $5 million last month. This aligns with Twitter's broader reduction in headcount.

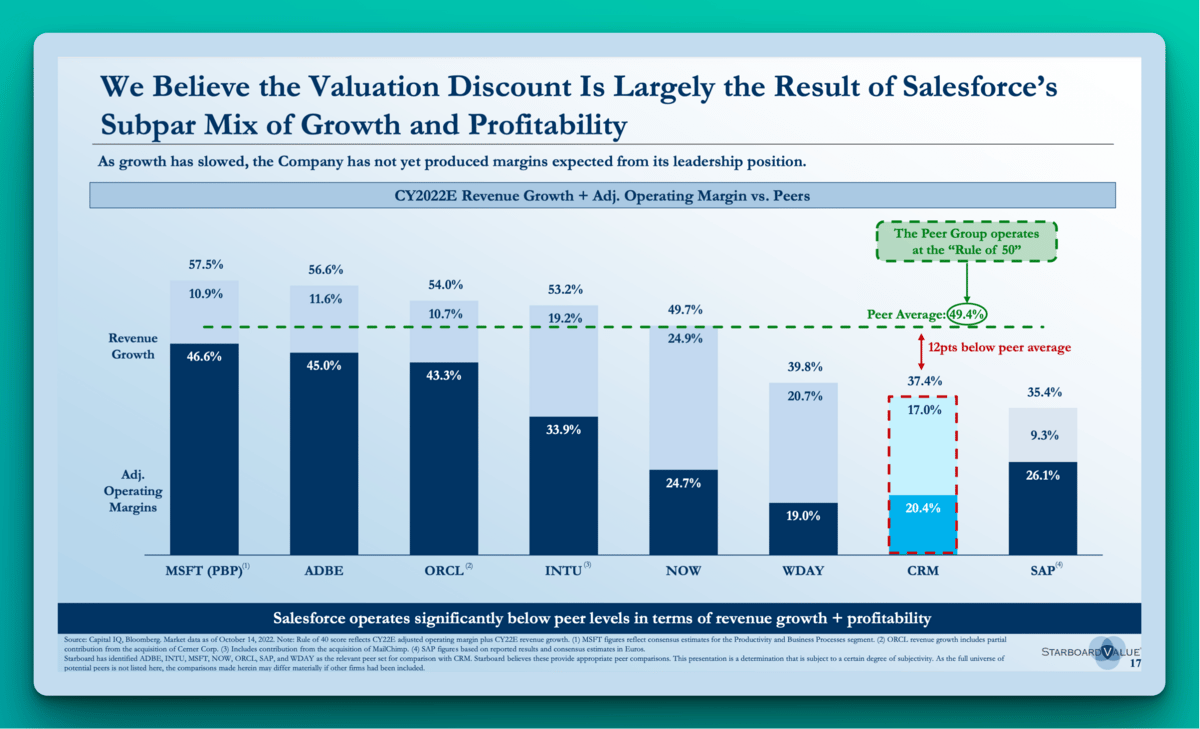

This comes at a time when Salesforce is facing pressure from activist investors, with Third Point Capital becoming the fifth investor to declare its interest in the company.

What is happening inside salesforce?

Market Value: Salesforce's market capitalization decreased nearly 50% in 2022, dropping from $250.3 billion at the start of the year to $132.6 billion by year's end.

Executive Attrition:

Former co-CEO Bret Taylor left the company on January 31 to start an AI company with a Google executive.

Slack CEO Stewart Butterfield departed at the end of 2022, shortly after Salesforce acquired Slack in 2021 for $28 billion.

New Ownership: Over the last few months, Salesforce has attracted activist investors seeking changes to boost its stock price:

Starboard Value (since October 2022)

ValueAct Capital Partners (since Q4 2022)

Inclusive Capital (since Q4 2022)

Elliott Management (since January 2023)

These Investors acknowledge the company's remarkable growth over 20 years but are unsatisfied with its performance relative to the broader market and industry peers. Specifically, they seek to expand margins, enhance business quality, and improve cash flow projections.

Ironically, last week, I wrote about the key metrics SaaS investors look at (Growth, Net Dollar Retention, Gross Margins, Rule of 40, Burn Multiple) based on a presentation by Salesforce Ventures' Jessica Bartos.

⚡️ Power Take: Besides Twitter, other companies are also grappling with their tech stack spend in the face of economic difficulties. Multi-year contracts with inflexible technology stacks limit many companies seeking cost reductions. As a result, they must lay off employees despite a desire to reduce spending elsewhere.

Additional reading: to deal with customer churn, companies are adopting usage-based pricing models and proactively identifying at-risk accounts.

French Startup Bibak Raises $6.4M to Replace Disposable Takeout Containers

While a SaaS newsletter might seem an unlikely place to discuss reusable containers, this company is doing just that - using software to help eradicate single-use plastics.

BIBAK offers an industrial technology solution that simplifies reusable packaging logistics.

The company began working with French corporate catering companies in 2018. It now targets the event industry and fast-food chains like Burger King.

It envisions a future where professional dishwashing services, not restaurants, wash food containers. Third-party logistics and washing companies are ready to handle this task. As a result, Bibak focuses on the technology and platform components of this industry.

Bibak's software provides real-time data on container inventory, facilitates the collection and management of used containers, and enables the administration of cashback and reward programs for end-users who return the reusable containers.

To date, over 1.5 million single-use packaging items have been avoided thanks to Bibak, according to its website.

⚡️ Trends playing in its favour: since January 1, 2023, restaurants have been required to use reusable food containers for dine-in customers.

Competition: Similar companies to Bibak include Pyxo and Swap Box.

How AI Can Streamline Operations, Increase Scalability, and Boost Profitability

I recently spoke with a CTO of a SaaS company that wanted to downsize the company's marketing team with AI for much of the copywriting work.

Non-surprisingly, artificial intelligence is infiltrating more aspects of businesses. On top of AI being incorporated into consumer and business apps, SaaS companies can benefit from AI in the following ways:

Leverage: automate repetitive processes and achieve more with fewer resources.

AI-powered chatbots can handle basic customer service, freeing up support staff to address more complex issues, notably problem that require human judgement and empathy.

In sales and marketing, for example, AI can analyze customer data and behavior to determine the likelihood of a lead converting or an account churning. Companies can then prioritize high-value leads and at-risk accounts, tailoring outreach to increase customer engagement and retention. By automating communications, teams have more time to work on growth strategies.

Scalability: serve more customers and handle higher volumes.

SaaS providers can gain insight into customer behavior and tailor their sales approach accordingly. For example, AI can be used to automate lead generation by scraping data to identify potential customers and qualify which leads are most promising.

The AI can then study the behavior and preferences of qualified leads to determine the best way to market to them, such as by providing targeted content and personalized recommendations.

Ultimately, the goal is to target and serve more customers without necessarily increasing a company’s operational costs.

Profitability: boost key metrics and performance.

Although AI implementation requires upfront investment, the future rewards of an AI-powered SaaS business likely outweigh the initial expenditures.

By learning customer data, AI can provides relevant upsells and tailored offerings that boost satisfaction and loyalty, increasing revenue and lifetime value.

With costs lowered by AI taking over repetitive tasks, SaaS providers can achieve stronger earnings and faster expansion in a sustainable, cost-effective manner.

For additional reading on how AI can enhance sales effectiveness, I recommend this article from the Harvard Business Review.

💸 Funding Rounds

SandboxAQ | $500m: AI and quantum computing solutions (link)

Demandbase | $175m Debt: account-based marketing, sales intelligence, and data company (link)

Descope | $53m Seed: build secure, frictionless authentication and user journeys for any application (link)

Puzzle Financial | $15m Series A: startup accounting software founders and accountants (link)

Zylo | $5m add-on Series C: SaaS Management and Optimization (link)

Bluetail | $2.2m: aircraft records platform for private aviation (link)

What did you think of today's newsletter? |

💬 If you have any feedback or suggestions for future topics, please don’t hesitate to reach out. Follow me on Twitter to stay in touch.